If I had £5k parked in a Stocks and Shares ISA right now, which FTSE 100 stock would I buy first? Well, it would depend on whether I was going for growth, dividends or a combination of both. If I were aiming for passive income though, I’d invest in Tesco (LSE: TSCO) shares today.

A strong year

While the FTSE 100 has laboured this year, Tesco shares have outperformed splendidly. They’ve returned 21% in 2023, and that’s without factoring in cash dividends on top.

There have been a few positive developments that have helped the shares really perform.

Should you invest £1,000 in Tesco right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesco made the list?

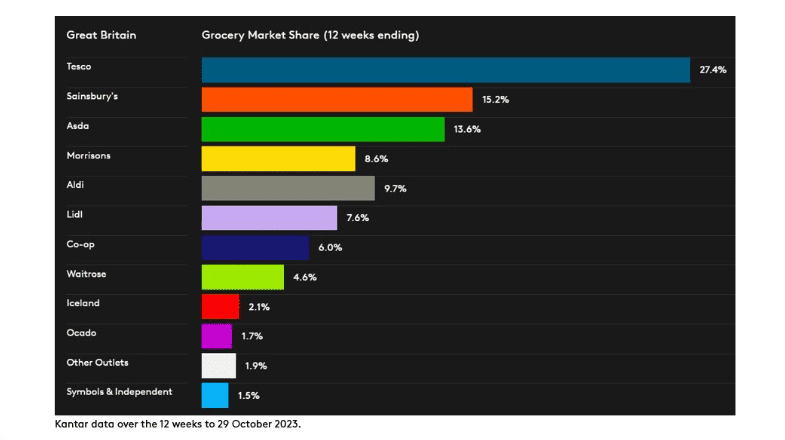

First, despite fierce competition from budget chains Aldi and Lidl, Tesco has strengthened its position as the UK’s top supermarket. Its Aldi Price Match strategy and cheaper prices for Clubcard customers have kept shoppers loyal.

In fact, according to Kantar’s latest October grocery report, Tesco gained share for the fourth consecutive month to take 27.4% of the market. That’s an increase of 0.4 percentage points versus a year ago.

In October, the firm also reported that half-year underlying retail operating profit rose 13.5% year on year to £1.4bn. This allowed it to slightly raise its profit outlook for the full year (Tesco’s financial year ends 25 February). It now expects underlying retail profit to be £2.6bn-£2.7bn.

Food inflation has been falling in recent months, which broadly benefits the firm in two ways. One, shoppers are less likely to feel the need to trade down to cheaper supermarkets and foods. Two, pinched pockets should have more cash in them for higher-margin, non-food items in store.

Finally, the company has been buying back its own shares. It has purchased almost £1.6bn worth of shares since October 2021.

Management sees its buyback programme as “an ongoing and critical driver of shareholder returns, reflecting the strength of our balance sheet and our confidence in delivering strong future cash flows“.

Generous dividends

The stock currently boasts a forward-looking dividend yield of about 4.6%. I find this attractive, as it’s more than I’d hope to get from the average FTSE 100 stock.

More specifically, it means a £5k investment could generate me annual income of around £230.

Of course, like any dividend, this isn’t guaranteed. But the prospective yield is covered twice over by next year’s forecast earnings. So there’s reassuringly strong dividend cover here.

Tesco bank

Beyond groceries and Booker (its wholesale business), there is of course Tesco Bank. In H1, it was boosted by higher interest rates and recorded £65m in adjusted operating profit, a 25% increase.

However, Tesco appears keen to sell its banking arm, with Barclays reported to be interested. The bank had a book value of nearly £1.5bn at the end of August.

Could shareholders enjoy a special dividend after any potential sale? Well, Tesco has paid them before, so it’s certainly possible.

Looking ahead, Christmas will clearly be a key period. An all-out festive price war wouldn’t be ideal, as it could see the discounters gobble up market share and would dent margins. This is worth watching, I’d say.

Whatever happens though, I’m confident enough Tesco Clubcards will be getting used to keep the dividends flowing. So if I had spare cash to increase my passive income, I’d add the shares to a diversified ISA portfolio in the months ahead.